When It Comes to Flood, You Don’t Have to Stay in Your Zone

October 13th 2025

I am a flood nerd, I admit it. I study geographies, topographies, weather maps, satellite feeds—all of it. When a flood event occurs, I study all those factors again…as well as the aftermath.

Given that nearly half of flooding in the United States happens in areas not considered high-risk flood zones, I continue to see how unprepared property owners and entire communities can be when flooding happens.

Flood events are not just a flooded basement or roof leak—they can be the loss of homes, businesses, town infrastructures, transportation, mail service, and sadly even lives.

So you can imagine my thoughts when my husband and I moved to the Gulf Coast, and our real estate agent said we didn’t need to get flood insurance for our new house located less than 10 miles from the beach. We added a flood policy anyway, which came in handy when our neighborhood flooded shortly after purchasing our home. And it had nothing to do with a hurricane. Multiple days of heavy rain flooded multiple neighborhoods in our community.

When you think about how large and in-demand our coastlines and interior waterfront properties are (lakes, rivers, etc.), plus how more regions are increasingly susceptible to flash flooding, it may surprise you that only four percent of homeowners in the U.S. have flood insurance.

Why are there so few residential and commercial flood policies in the U.S.? For private insurance companies, it is often because the risk is too high—it’s hard to assess and therefore gets priced higher, which can lock out a lot of populations who view it as an unnecessary or downright unaffordable expense. Also, outdated flood maps can create a false sense of security for homeowners, agents, and realtors alike, lessening the perception of importance to obtain flood insurance. In addition, many homeowners do not know that flood is not covered under their homeowner’s policy.

Currently, residential and commercial properties in special hazard flood areas are only required to be covered by a flood insurance policy through the National Flood Insurance Program (NFIP) established by Congress in 1968 or an equivalent private policy if they have a federally backed mortgage. The NFIP program provides affordable insurance to property owners, and it also encourages communities to adopt and enforce floodplain management regulations to prevent loss of life and property.

So what should you do if you’re an insurance agent, realtor, homeowner or business owner who wants to expand your home or business insurance coverage to include flood?

- If you are a homeowner:

- Talk to your agent about your actual flood risk and options for NFIP or private flood coverage and get the protection and peace of mind you need.

- If you are an agent or realtor:

- Know the reality of the risk of flooding and ensure your customers are fully prepared to handle the risk of flood. The danger and likelihood of flooding is not limited to special flood hazard areas; all zones are flood zones. Make sure your customers know what is and is not covered under their policy(s).

- Make sure your customers know that flood coverage has to be added; it does not come standard with a homeowner’s policy.

- Know where to go to understand the risk of flood, what flood zones mean, how to buy an NFIP policy or endorse a private policy to cover flood, and how to discuss the risk of flood with your customers.

- If you are an insurance company:

- Talk to your representatives and agents about the peril of flood. Talk about why flood is so underrepresented in the insured market.

To find out how Davies can help with comprehensive Claims Solutions including Catastrophic, Property & Casualty and more, visit davies-group.com/NorthAmerica.

-

July 24th 2025

Davies expands flood division to manage large-scale claims in North America and appoints Jessica Chambliss as senior vice president

North America – July 24, 2025 – Davies, the leading specialist professional services…

-

February 5th 2025

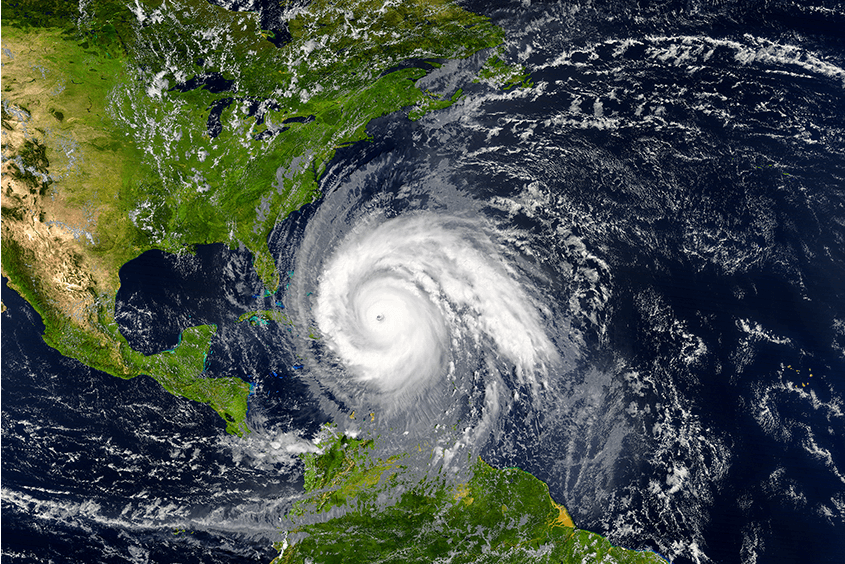

2024 CAT Season Recap: A Year of Unprecedented Storms & Lessons Learned

The 2024 Atlantic hurricane season will be remembered as one of the most…

-

November 4th 2025

Roof Inspections: 8 Reasons Our Team Gets It Right…the First Time

When it comes to property assessments for insurance surveys and risk evaluations, roof…